💸 Discover the Secret to Smarter Spending

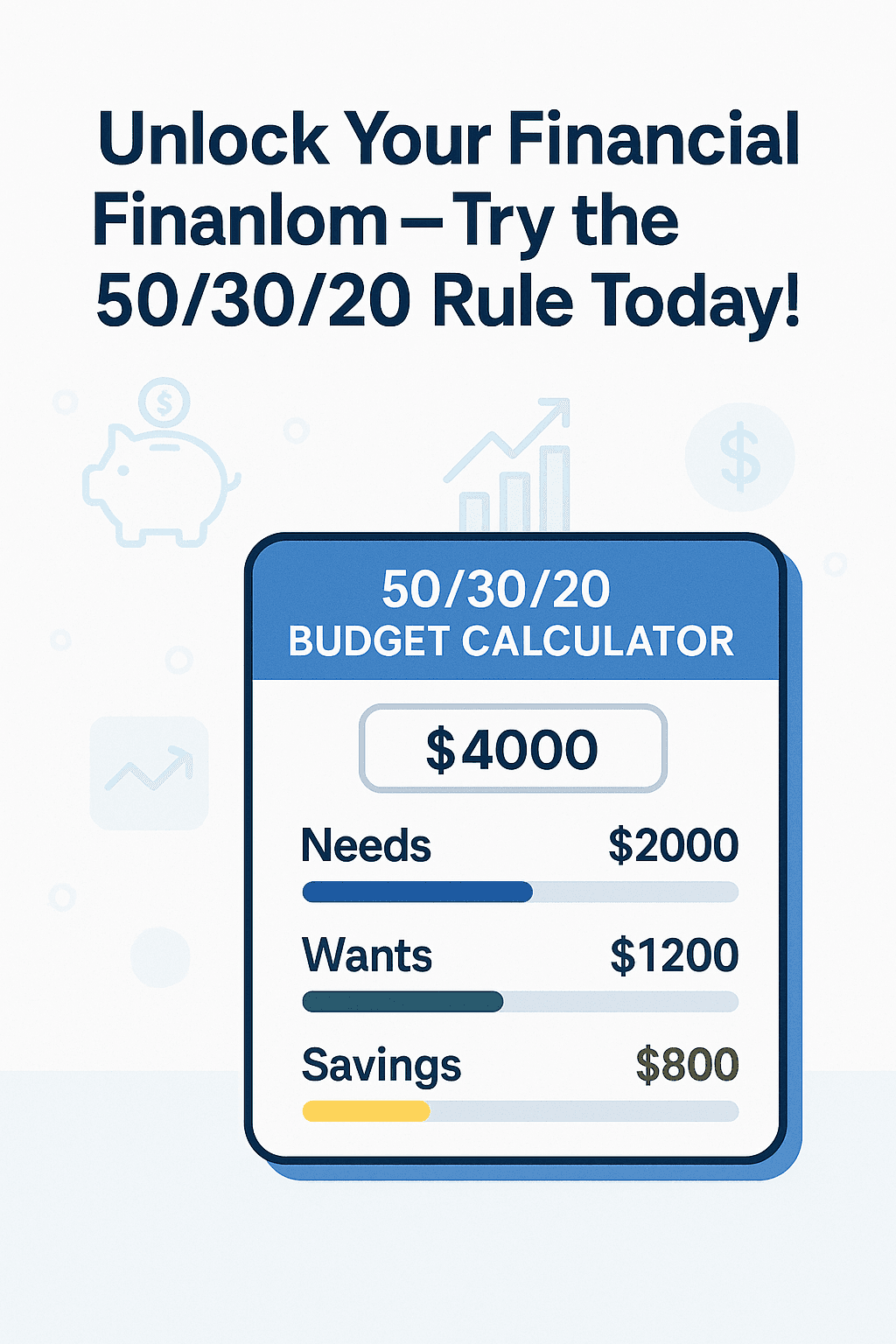

Use our 50/30/20 Budget Calculator to take control of your money in seconds. Break down your monthly income into essentials, lifestyle, and savings with ease.

Try It Now – It’s Free!📘 What is the 50/30/20 Budget Rule?

The 50/30/20 budgeting rule is a simple yet powerful framework that helps you manage your income effectively:

- 50% Needs: Rent, utilities, food, insurance – everything you must pay.

- 30% Wants: Dining out, movies, hobbies, entertainment.

- 20% Savings: Emergency funds, debt repayment, future goals.

By following this rule, you’ll find it easier to stay financially balanced while enjoying life and preparing for the future.

📊 Calculate Your Budget

Needs (50%)

$0

Wants (30%)

$0

Savings (20%)

$0

💡 How Your Money is Spent Using 50/30/20

This budgeting method is ideal for managing personal finances and maintaining financial stability. Here’s how your expenses break down:

- 50% Needs: These are essentials you cannot avoid — think rent, groceries, electricity, healthcare, and transport.

- 30% Wants: These are your lifestyle choices. This includes your streaming subscriptions, vacations, dining out, or your favorite hobbies.

- 20% Savings: This part goes toward building an emergency fund, investing for the future, or paying off existing debt.

🎯 Why Use This Budgeting Tool?

- ✅ Instantly visualize your money flow

- ✅ Avoid overspending and reduce financial stress

- ✅ Build wealth and pay off debt faster

- ✅ 100% free, private, and beginner-friendly

❓ Frequently Asked Questions

What income should I use?

Enter your monthly income after tax. This gives a more accurate picture of your real spending power.

Can I use this annually?

Yes! Simply enter your annual income instead. The calculator still applies the 50/30/20 percentages.

Do I need to sign up?

Nope. This tool is completely browser-based, private, and free. We don’t track or store any data.

📈 Start Budgeting Smarter Today

Join thousands of users who are taking control of their money—one step at a time.

Calculate My Budget