🏆 Risk Reward Ratio Calculator

📈 Plan Smarter Trades & Protect Your Capital

In trading, every decision matters. Our Risk Reward Ratio Calculator helps you evaluate your trades before you enter them—so you can protect your capital and maximize your potential profits. Whether you’re trading stocks, forex, or crypto, knowing your risk-to-reward ratio is crucial for building a sustainable strategy.

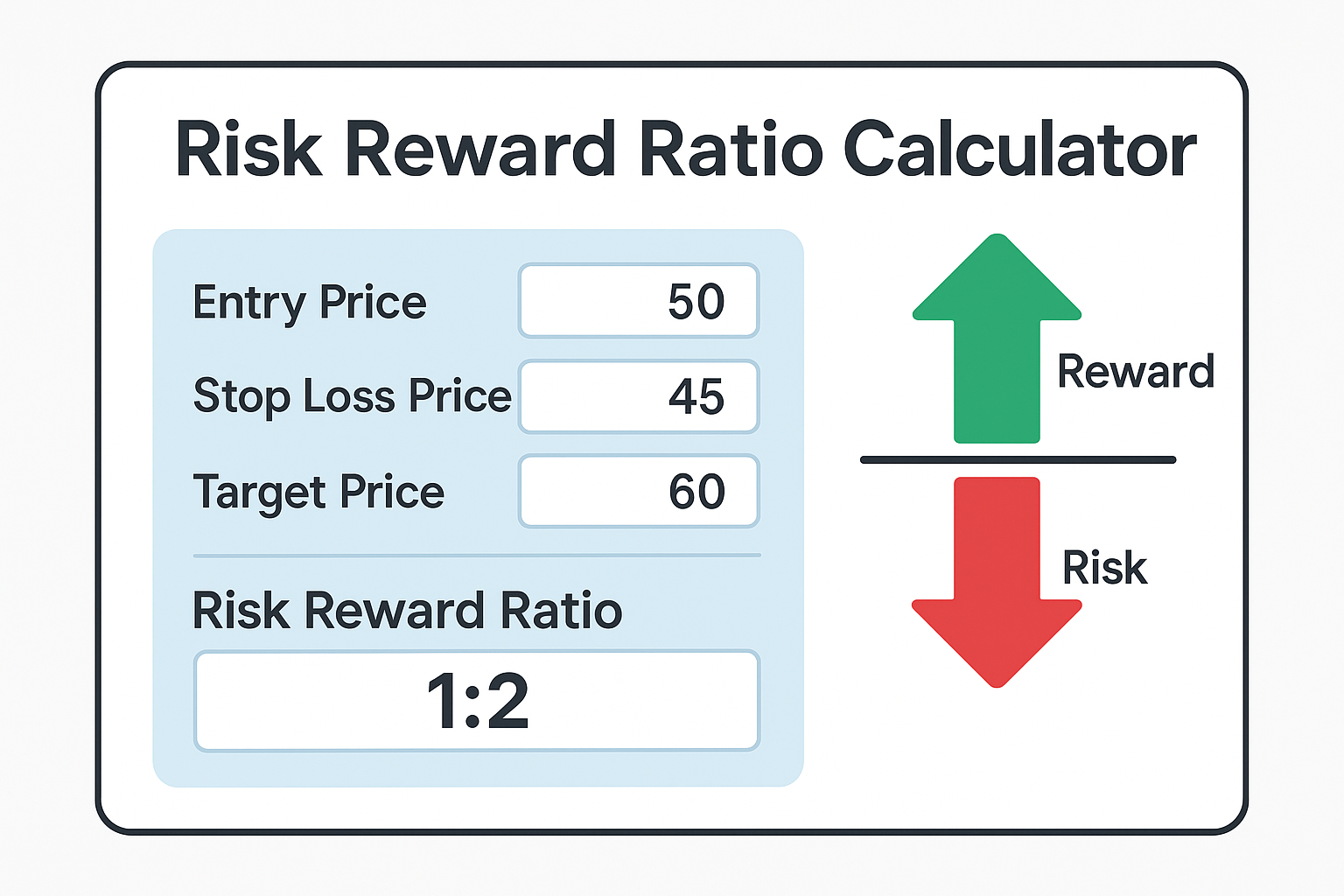

Calculate Your Trade Setup

Real-Time Formula Example

For a Long trade, the formula is:

For example, if your Entry Price is USD 0, Stop Loss Price is USD 0, and Target Price is USD 0:

Risk : USD 0

Reward : USD 0

Risk Reward Ratio : 0 / 0 = 0

💡 What is a Risk Reward Ratio?

The Risk Reward Ratio is a simple yet powerful tool that tells you how much you’re risking compared to the potential reward on a trade. In other words, it measures how much you could lose if a trade goes against you versus how much you could gain if it goes in your favor.

- For example: If you're risking $100 to potentially make $300, your risk reward ratio is 1:3.

A good ratio helps you:

- Limit losses

- Focus on high-probability trades

- Grow your account consistently over time

🔢 How to Use the Risk Reward Ratio Calculator

This tool allows you to quickly assess the risk-reward setup for your trades. Here's how you can use it:

- Step 1: Input your Entry Price, Stop Loss Price, and Target Price based on your trade setup.

- Step 2: Select the currency and trade type (Long or Short).

- Step 3: Click "Calculate" to get the Risk, Reward, and Risk-Reward Ratio.

The Risk-Reward Ratio tells you how much reward you stand to gain for each dollar of risk. A ratio greater than 1 means you're aiming for more reward than the risk you're taking.

Advanced Tips for Effective Use

Here are some tips to help you make the most of your Risk Reward Ratio calculations:

- Ideal Ratio: A ratio of 2:1 or higher is generally considered ideal, as it ensures your potential reward outweighs the risk you're taking.

- Account for Slippage: Slippage is the difference between the expected price of a trade and the actual price. Be mindful of this when calculating your potential reward.

- Use Multiple Scenarios: Try calculating your Risk-Reward Ratio for multiple targets (e.g., conservative, moderate, and aggressive) to see how different setups impact your strategy.

🔍 Ideal Risk Reward Ratios for Different Markets

Different markets have their own volatility, so your risk reward goals may vary:

| Market | Ideal Risk-Reward Ratio | Why It Works |

|---|---|---|

| Stocks | 1:2 or higher | More stable price movements |

| Forex | 1:3 or higher | Higher volatility, greater opportunity |

| Crypto | 1:3 or higher | Highly volatile, riskier environment |

| Commodities | 1:2 or higher | Medium volatility, steady trends |

⚙️ Try the Risk Reward Ratio Calculator

Ready to take your trading to the next level?

Use our calculator below to analyze your next trade setup:

Simply enter your values, and let the calculator do the rest!

🚀 Tips to Improve Your Risk Reward Ratio

Looking to get better results? Here are some practical tips:

- Use tighter stop losses without compromising your strategy.

- Focus on high-probability setups rather than chasing every move.

- Avoid emotional trading — stick to your plan.

- Consider scaling into winning trades to maximize returns.

- Keep a trading journal to review your risk reward performance over time.

📊 Why Risk Reward Ratio Matters in Trading

Trading without a plan is like sailing without a compass. The Risk Reward Ratio Calculator keeps you focused on trades that make sense by:

- Managing Risk: Limiting losses before they spiral out of control.

- Maximizing Profits: Prioritizing trades with higher potential rewards.

- Improving Consistency: Helping you stick to your trading strategy.

- Boosting Discipline: Removing emotions from your decision-making.

Whether you're a day trader or long-term investor, proper risk management is the backbone of successful trading.

❓ Frequently Asked Questions (FAQs)

What is a good Risk Reward Ratio?

A common recommendation is 1:2 or higher, meaning you risk $1 to make $2. The higher the ratio, the better the potential reward relative to your risk.

Is a 1:1 Risk Reward Ratio worth it?

A 1:1 ratio means you’re risking as much as you could gain. While not ideal for long-term growth, it may work in high-probability setups.

Does Risk Reward Ratio guarantee profits?

No—nothing in trading is guaranteed. However, using a solid risk reward ratio improves your chances of staying profitable over time.

Should I calculate the Risk Reward Ratio for every trade?

Absolutely! Consistently calculating your risk reward ratio helps you stay disciplined and avoid impulsive trades.

Our Futuristic Tools

Budget Calculator (50/30/20 Rule)

Break down your income into needs, wants, and savings effortlessly.

Free Try Now

Background Remover

Remove backgrounds from images instantly with our AI-powered tool.

Free Try Now

Life Insurance Commission Calculator

Calculate your life insurance commissions easily with our tool.

Free Try Now

Excel to PDF Converter

Convert your Excel files to PDF format quickly and easily.

Free Try Now

PDF to PNG Converter

Convert your PDF files to PNG format effortlessly.

Free Try Now

Risk Reward Ratio Calculator

Use our free Risk Reward Ratio Calculator to plan smarter trades. Instantly calculate your potential risk and reward before entering any trade. Boost your trading success today!

Free Try Now🎯 Start Planning Your Trades with Confidence

Don’t leave your trading success to chance. Use our Risk Reward Ratio Calculator to evaluate every trade, minimize losses, and maximize your profits—one calculated step at a time.

Trade smart. Manage risk. Grow consistently. 💼